The four horsemen of the tech recession

The tech industry has been suffering in recent weeks with mass layoffs of several big names such as Amazon, Apple, and Salesforce, to name a few.

Aside from the hundreds of thousands of lost jobs, it's curious to try to understand what has caused these layoffs in a market that appears to be "recession-proof" (quotes properly placed to remind us that we have gone through periods of great recession such as the dot-com bubble burst, for example).

I found this interesting article (https://stratechery.com/2023/the-four-horsemen-of-the-tech-recession/) from stratechery.com that I share with you in this post.

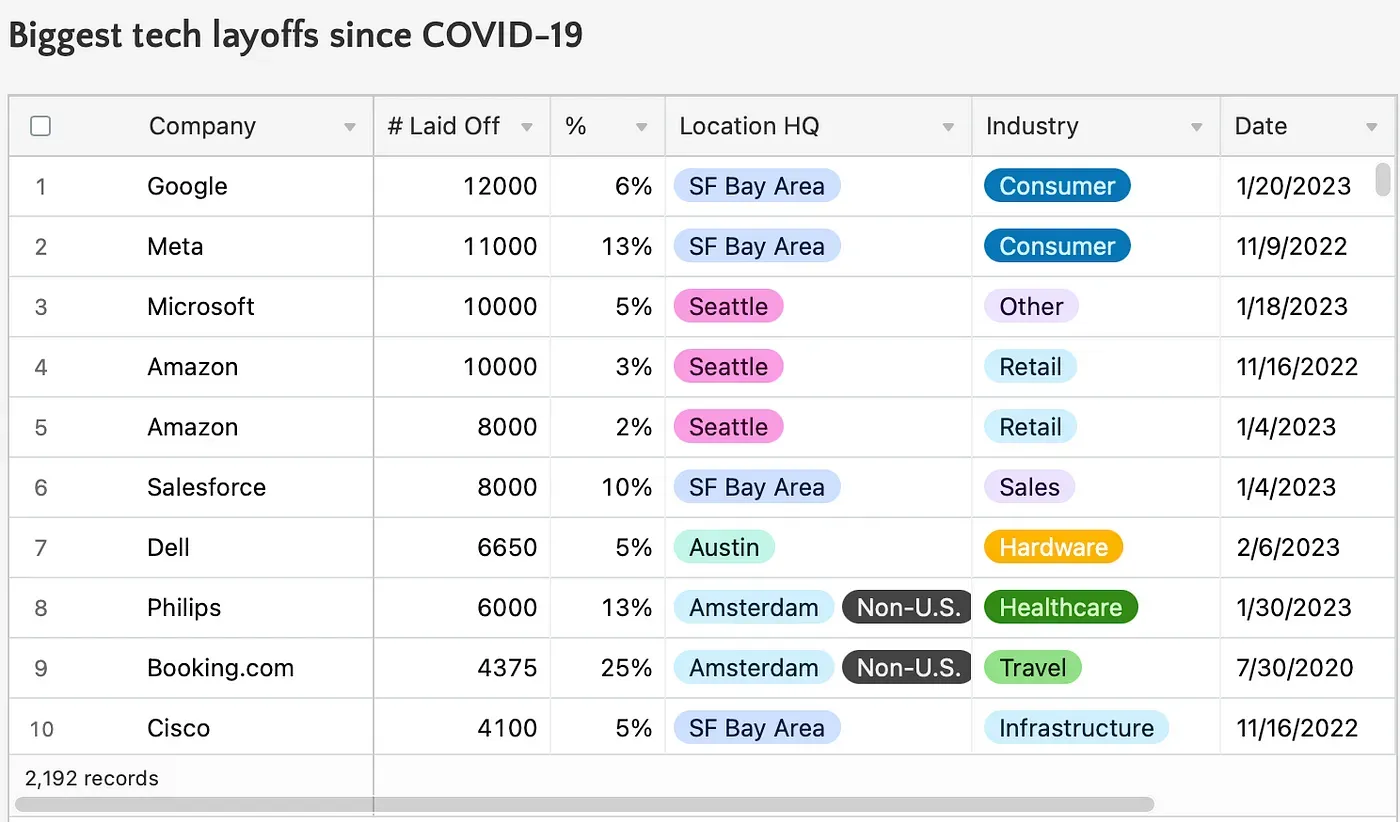

But before we start, some numbers extracted from layoffs.fyi today (February 7, 2023):

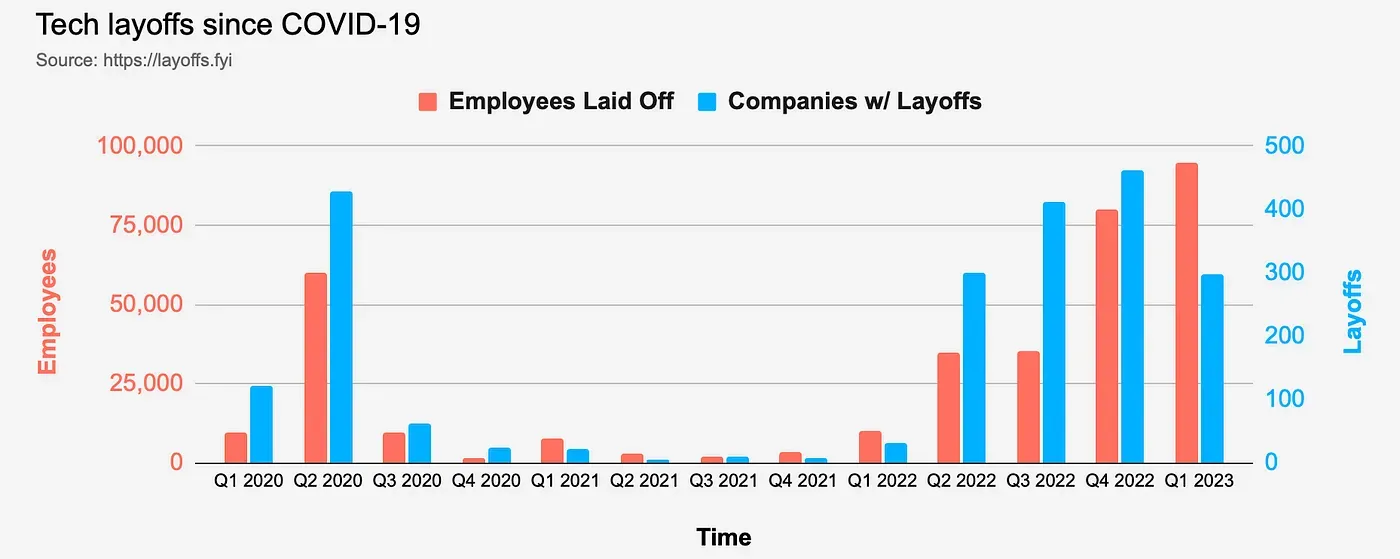

And a comparative chart of layoffs since the beginning of Covid:

Peak of 60k layoffs in the second quarter of 2020 versus 95k in the first quarter of 2023!

Well, let's go to some of the causes:

Knight 1 - The Covid Hangover

Okay, Covid hasn't ended and won't end. Several industries were heavily affected by the pandemic. Some proved to be "Covid Friendly," especially some tech companies.

We can observe a surge in demand in several of the big tech companies. Logistics/Last Mile (Amazon), entertainment (Netflix, Microsoft/XBox, ...), cloud infrastructure (AWS, Microsoft, Google), SaaS companies in general (Zoom, Slack, Salesforce, ...).

Many of these companies grew their workforce and increased their necessary investments in infrastructure to be able to meet demand, but "post-Covid" the demand did not remain. Look at the recent drops in Netflix and Zoom, for example. The world moved on, and projected demands were not linear.

This particularly affects companies that need to make upfront investments (read all the infra bigs - AWS, Azure, GCP) that now see idle data centers. The big selling point of the cloud has always been the ability to "give back" unused infrastructure to the provider, the elasticity we have with the cloud and that we didn't have when we lived in the "on-premises" world, gives comfort to the service consumer (all SaaS companies) but is a risk for providers.

Knight 2 - The Hardware Cycle

Major production issues associated with the supply chain (severely impacted by lockdowns in China) have affected large companies like Apple. iPhones not manufactured are iPhones not sold, and we've had many recent production disruptions (and perhaps more given the recent surge in Covid cases in China and related protests at Foxconn).

The PC market also seems to be in a constant decline. Microsoft reported a 39% drop in OEM sales.

Migration to other architectures (ARM) may have also shaken up the PC market. Intel needs to reverse this trend, as it has already lost the race for mobile processors and now seems to be starting to lose the race for its mainstay, which is PCs. We shall see...

Knight 3 - Interest Rates

How does the market interest rate affect tech companies? Basically, in everything - from startups seeking investment and finding that resources are scarcer because investors are not willing to take the risk when they have more attractive interest rates, to the valuation of big companies, which depend on long-term revenue, and when brought to present value at a higher rate, can become worthless.

Knight 4 - Advertising Revenue and "App Tracking Transparency"

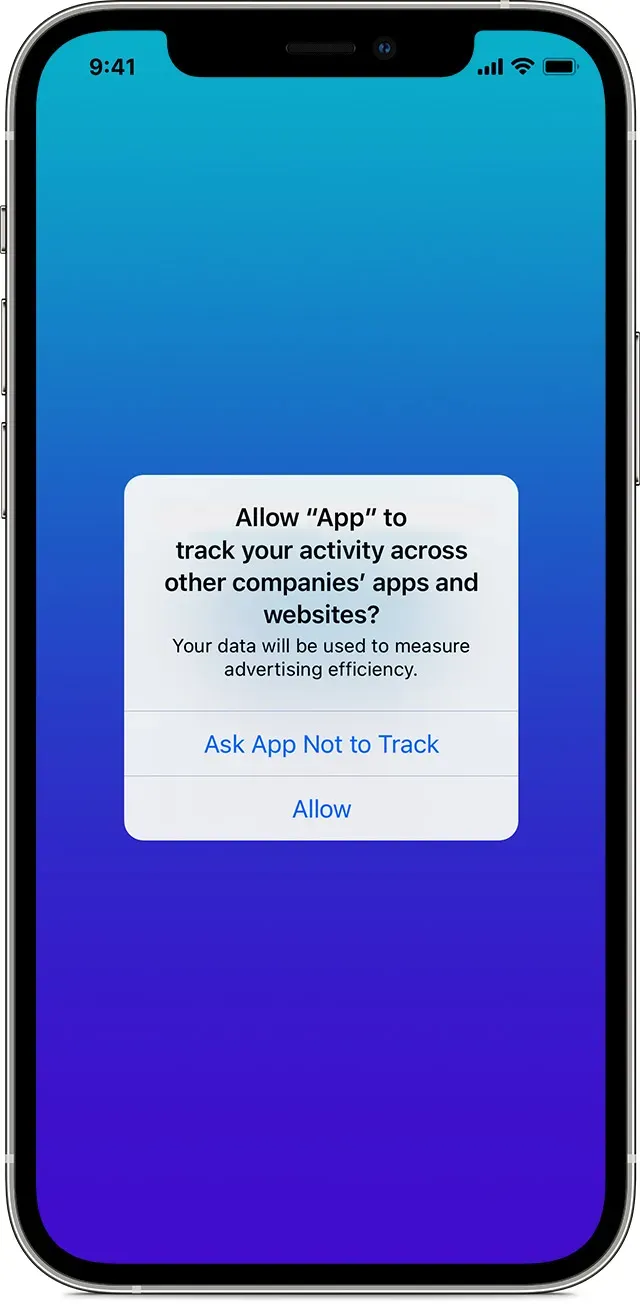

It may seem like a trivial matter, but Apple's initiative has had a significant impact on companies that rely on advertising (which is a big part of the big players like Meta, Google, etc.). This feature (see image below) was introduced in iOS 14.6 in 2021, which started to prevent greater tracking of users between applications...

A report from 2021 pointed to a 7% drop in revenue for Facebook/Meta due to this "simple change" in iOS (https://mobiledevmemo.com/facebook-may-take-revenue-hit-from-apple-privacy-changes/).

More Knights out there?

Certainly and unfortunately we have several other Knights on the loose...

Will the massive investment in the metaverse made by Meta/Facebook prove to be profitable? So far, it seems to have been a shot in the dark, with great difficulty in making the use of the metaverse practical. Time will tell whether the metaverse will succeed or not...

Google's main business model (search engine generating revenue from ads and sponsored pages) may face a major threat from Microsoft's recent announcements in partnership with OpenAI and ChatGPT. What if instead of searching for a topic and receiving a list of pages, you could simply ask an artificial intelligence a question? This could directly affect Google's revenue model! And what would be the new revenue model to enable conversational AI models like ChatGPT?

We still have a long way to go... And today (Feb-7-2023), Microsoft announces news with its partnership with ChatGPT. Let's see what's coming next...