Castles protected by moats

"I look for economic castles protected by unbreachable moats", Warren Buffet.

The context of protected castles refers to companies that are difficult to destroy. Businesses that bring value to customers and shareholders, with sufficient protections, barriers, or moats to make it difficult or impossible for competitors to advance and take that "castle."

But how do you create a lasting company/business/product that survives fierce competition and new entrants who are increasingly faster with the use of artificial intelligence? This is a reinterpretation of Hamilton's 7 Powers (Book 7 Powers - https://amzn.to/49KDrs0) for today's world.

The topic has become hot after a recent publication by Y Combinator, and it's worth reflecting on this for your business.

First of all, what is a moat? A moat is a benefit or a barrier to entry for a competitor of your company or product. Let's see:

- Benefit - The company must have a material advantage over competitors, manifested in lower costs or the ability to charge higher prices (larger margins).

- Barrier - A structural obstacle that makes it impossible or excessively costly for a competitor to imitate this benefit.

Without the barrier, the benefit is momentary. Without the benefit, you may have a moat around something worthless (a "shack" instead of a "castle").

In a free market, if you have high margins, competitors will want to "eat your lunch." Without a moat, infinite competition will eventually reduce your profits to zero.

"All happy companies are different: each one earns a monopoly by solving a unique problem. All failed companies are the same: they failed to escape competition.", Zero to One: Notes on Startups, or How to Build the Future, Peter Thiel & Blake Masters (https://amzn.to/4a9SDAl).

This quote from Peter Thiel's book "Zero to One" points to an important principle of the book - monopolies created from the impossibility of competition. Back to our moats!

And what is not a moat? A classic example to consider is operational excellence - Having the best team, the best culture, or flawless execution is not a durable defensive moat because it can be copied. A competitor can replicate your process, hire your employees, etc. Operational excellence is an obligation. It's a treadmill you have to walk on to avoid being crushed by daily competition, but you're running without getting anywhere in terms of permanent structural advantage.

Speed

Speed is the fundamental power of a startup. It's the first one to pursue. Relentless execution and speed are certainly the two most important characteristics of a company that is being born. There's no point in thinking about creating a product in 6-month cycles. You won't have the stamina for that. The market won't wait for you.

Cursor (cursor.com) did 1-day sprints, delivering value and developing and shipping new features daily. It became a reference in AI development.

AirBNB with its constant A/B testing. Rapid changes in the conversion funnel.

Stripe with its simple and clear APIs, allowing quick integration in minutes instead of weeks from traditional players.

Build your castle first and quickly! But speed isn't just about doing things fast - it's about learning, adapting, and dominating before others.

The moats come next. Build your treasure before thinking about the vault.

Process Power

Process Power is an application's ability to solve the customer's last and complex mile. You know that incumbent who made a solution at the weekend hackathon? They will never be able to match a solution that has "Process Power."

It's solving the "hard and meticulous" work. The work needed to take a product from 80% to 99% reliability or delivery. Something that competitors can't or won't do.

A good example of this is Plaid in the USA. Founded in 2013 as middleware for applications to access banks through APIs, they connect more than 12,000 financial institutions, fintechs, payment apps, financial management, loans, etc. in the USA, Canada, and the United Kingdom. They are the invisible plumbing that makes hundreds of applications work. Venmo, Robinhood, Chime are some of Plaid's customers. It's not the type of integration that is born overnight, keeping them working must be extremely complex, and for a competitor to emerge is very difficult. The moat here is complexity, translated into Process Power.

A risk to Plaid tomorrow could be government regulation. Who knows if the USA decides to implement an Open Banking that actually works? But that's another story...

I founded a company (Trixlog) back in 2008 that did Vehicle Telematics. Since vehicles in Brazil didn't have a standard communication protocol, we did a lot of grassroots work to certify dozens of different manufacturers and hundreds of vehicle models. In 2022, when I sold this operation, we had the largest heavy vehicle telematics base in Brazil. Since most of our clients' vehicle base was mixed (composed of vehicles from different manufacturers and years of manufacture), we were the only company that had the capacity to read data from the entire fleet and interpret this data to do driver behavior (understanding how a driver drives their vehicle and through gamification instructing them and improving every day). A competitive advantage that's hard to counter. A moat based on process power.

Cornered Resources

The "Cornered resource" moat refers to those resources that are difficult to access. Because the competitor doesn't have the institutional relationship, certifications, exclusive data, etc., and getting this isn't just a matter of capital. It's not something you easily copy with money or reverse engineering.

Palantir (palantir.com) is a company founded by Peter Thiel in the USA that focuses on "AI-driven decisions" for American government agencies such as CIA, FBI, NSA, DoD, and other agencies like NATO, Five Eyes, etc.

Imagine the level of complexity and need for "clearance" to provide critical services to these types of agencies? It's not something you get overnight, and for a competitor to try to compete, in addition to the complexity of replicating the technology, there's the entire barrier of connections established over years.

The pharmaceutical industry is another great example of cornered resources. An extremely profitable market but extremely complex for new entrants. Many regulations and extremely long product launch cycles keep small competitors away from this race.

Switching Costs

Here we work on the cost of change. With an important caveat and an example of what not to do from the software industry of the 1990s. At that time, companies like Microsoft and IBM created intricate switching cost barriers with their customers through closed architectures that were difficult to interconnect with competitors. This was a moat for years, until open standards and revolutions caused by the open source world brought down empires. Switching costs is not a moat where you lock the customer in your impenetrable castle. It's a moat that makes your customer feel so locked in (and happy!) by all the features and integrations your application has brought that they simply see no advantage in replacing it.

I've been a Spotify user for years. Spotify has, in practice, the same songs as any other competitor (Deezer, Amazon, Apple, etc.), but no one dare touch my playlists, curated and carefully built over years!

Salesforce, when implemented in a corporation, is super complex to replace. It ends up having so many integrations and bringing so many business rules that switching becomes a nightmare.

But here's a word of caution - switching costs in the age of AI may start to diminish in significance. LLMs are great at interpreting complex scenarios and rewriting code or translating to other languages.

Imagine, for example, the great migration that Amazon did from Oracle to other databases - PostgreSQL, MySQL, and Dynamo (which emerged as a response to this migration). The feud was so big that there's even a video on YouTube celebrating the last Oracle turned off inside Amazon (https://www.youtube.com/watch?v=9yBP5gnnZi4).

Today, a migration like this would be greatly facilitated by LLMs. Imagine asking Claude AI, for example, to rewrite all that complex code written in Oracle's proprietary language (PL/SQL) to PostgreSQL? What would take you days could be done in seconds.

Be careful here with this Moat. Switching costs with a customer held hostage is never a good path.

Counterpositioning

The best summary for counterpositioning is - create a business model that established businesses cannot copy. They can't copy because it would cannibalize their main business.

A recent example of this is the LLM battle. Google launched the technological foundation of LLMs with the paper "Attention is all you need" (https://en.wikipedia.org/wiki/Attention_Is_All_You_Need) in June 2017. OpenAI launches ChatGPT in November 2022 and becomes synonymous with AI for the general public.

The point here is that ChatGPT cannibalizes Google's main revenue model, which is Ads. The moment people stop searching on Google, which sells Ads in search, and start asking ChatGPT, they cannibalize Google's main source of revenue. If Google had launched Bard (the solution before Gemini) earlier, it could have been seen internally as a threat to Google's business model rather than an opportunity. It ended up being a response to the competitor rather than innovation and first mover.

Today Google is playing catch-up. Bard died. Gemini was born. And they have invested a good portion of effort in specializing and surrounding Gemini with Process Power - see the entire ecosystem around Gemini like Nano Banana (image generation), Notebook LM, Veo, etc.

Another "classic" example was the battle between Netflix and Blockbuster, where the entrant Netflix created a business model (streaming) that cannibalized Blockbuster's established business model (DVD rental and late fees).

Or Kodak, which invented digital camera technology but saw the solution as a threat to its lucrative business of selling film. History is there to teach us a lot...

Network Economy

Network Economy happens when the value of a product or service increases for all users as new users join it.

An example is ChatGPT getting smarter as more users use the service, as inserted data is used in training.

Gemini learns from user data, reading their Gmail, Calendar, etc., and having the ability to give more accurate answers to these users. Feedback is collected across the entire network and this data is also used for training.

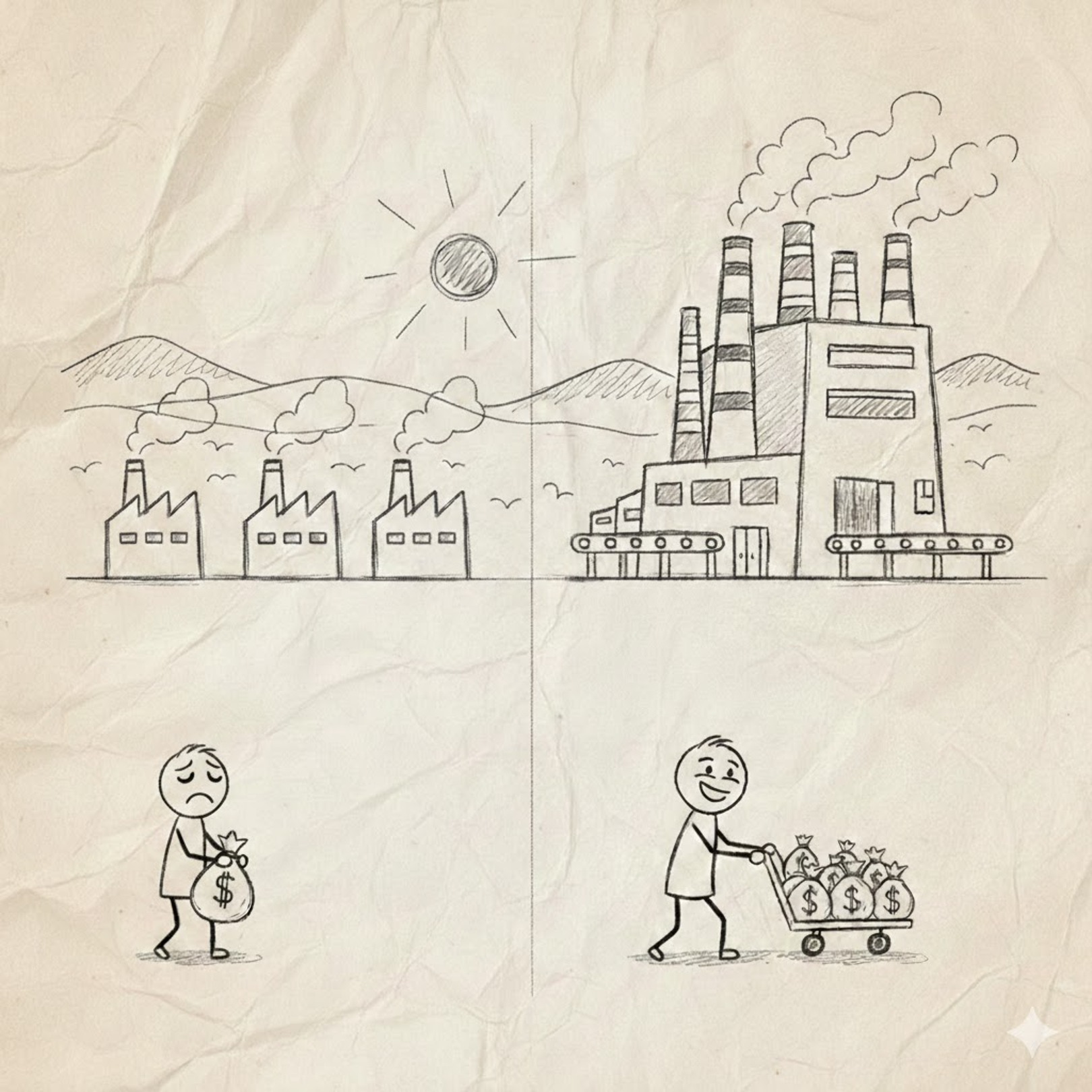

Scale Economies

Scale Economies occur when the cost per unit of a product decreases as production volume or users increase.

A classic example here once again is Netflix. Netflix pays the big studios to display movies to its users (variable cost). The moment it produces its own content, it turns this cost into a fixed cost, distributed across its entire user base. That's why these large streaming networks became major content producers.

Important milestones here - 2018 was the first year the Oscar was given to a streaming network - Icarus wins in the best documentary category, and in 2019 Roma becomes the first Netflix film to be nominated for best picture, showing Netflix's Scale Economies effort.

Brand

It's easy to cite ChatGPT as an example of brand because it has become synonymous with Artificial Intelligence for the general public. Google had to rename its former Bard platform and launch Gemini as a strategy to show renewal.

Apple (iOS) has higher profitability than all Android sales, despite a smaller market share. Apple's brand created a mass of fans willing to pay much higher prices than they would pay for the competitor.

But a common mistake here with brand creation is thinking about it before building your castle. If you're a startup, first create an incredible product and only then think about brand.

A footnote is worth mentioning here about this Google vs OpenAI battle. OpenAI started using the forces of Speed, Counterpositioning, Brand (today it's synonymous with AI for the general public), but Google fights with strong weapons - Process Power (with the entire complementary product suite - Nano Banana, NotebookLM, ...), Network Economy (Gemini users benefit because Google's AI can understand their context better with Gmail, Calendar, etc.), Scale Economies (Google has its own datacenters and the cost per user is lower than OpenAI's), and for me the most important - stability and long-term vision.

An example of Google's stability - a large part of Google's advisory board has been there since the beginning. John Hennessy (https://en.wikipedia.org/wiki/John_L._Hennessy) has been there since 2004! Google is playing a long-term game. OpenAI is playing a power struggle game that doesn't seem very healthy for the company's long term, see the firing, rehiring of Sam Altman, departure of Mira Murati (former CTO), departure of Ilya Sutskever (co-founder)...

Time will tell who will win this battle.